Discover Wyoming Credit Unions: Comprehensive Financial Services Near You

Discover Wyoming Credit Unions: Comprehensive Financial Services Near You

Blog Article

Experience the Distinction With Cooperative Credit Union

Membership Benefits

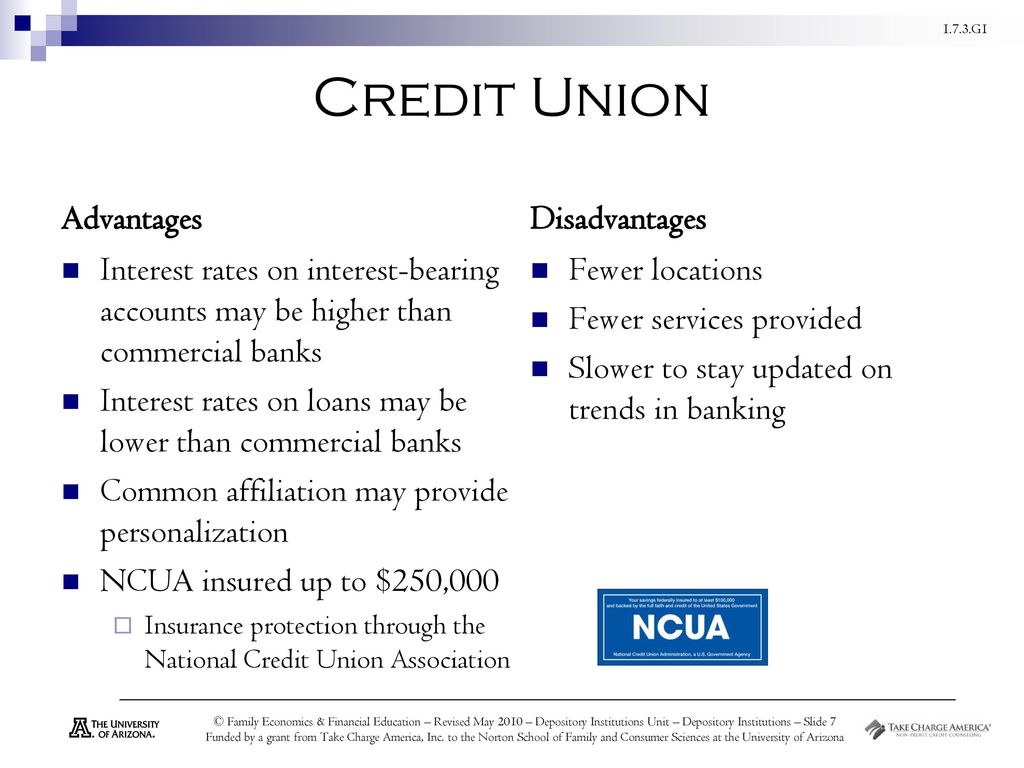

Credit rating unions provide a variety of useful benefits to their participants, differentiating themselves from typical banks. Unlike financial institutions, credit score unions are had by their participants, who additionally have voting civil liberties to elect the board of supervisors.

One more substantial advantage of credit unions is their concentrate on neighborhood participation and assistance. Many cooperative credit union actively participate in neighborhood advancement jobs, monetary education programs, and charitable efforts. By promoting a strong feeling of community, debt unions not just provide financial services but likewise add to the general wellness and prosperity of the communities they serve.

In addition, lending institution prioritize monetary education and empowerment (Wyoming Credit Unions). They provide resources and assistance to help members make notified decisions about their funds, boost their credit history, and achieve their long-term economic objectives. This commitment to education sets credit scores unions apart as trusted economic companions devoted to the economic well-being of their participants

Individualized Client Service

Supplying tailored assistance and customized interest, cooperative credit union succeed in supplying customized customer care to their members. Unlike traditional banks, credit history unions focus on developing solid partnerships with their members, concentrating on understanding their one-of-a-kind requirements and monetary objectives. When a member interacts with a cooperative credit union, they can anticipate to be treated as a valued person as opposed to simply an account number.

Credit history unions often have regional branches that permit face-to-face communications, improving the individual touch in customer care. Participants can speak directly with educated team who are committed to helping them navigate economic choices, whether it's opening a brand-new account, using for a funding, or inquiring on handling their finances. This customized technique collections cooperative credit union apart, as participants feel supported and equipped in accomplishing their economic purposes.

In addition, lending institution likewise supply hassle-free electronic banking solutions without endangering the individual link. Participants can access their accounts on-line or with mobile applications while still obtaining the same level of customized assistance and care.

Competitive Rate Of Interest Rates

When seeking monetary items, members of cooperative credit union gain from affordable rate of interest prices that can boost their financial savings and obtaining possibilities. Cooperative credit union, as not-for-profit banks, frequently offer more desirable rates of interest contrasted to typical banks. These competitive prices can use to different monetary products such as financial savings accounts, deposit slips (CDs), individual financings, home mortgages, and bank card.

One of the essential advantages of credit rating unions is their emphasis on serving participants rather than optimizing revenues. This member-centric approach permits cooperative credit union to prioritize supplying lower rates of interest on fundings and greater rates of interest on cost savings accounts, providing participants with the opportunity to grow their cash much more properly.

Furthermore, credit unions are understood for their desire to deal with participants that may have less-than-perfect credit rating. Despite this, cooperative credit union still aim to keep competitive rate of interest, guaranteeing that all participants have accessibility to budget friendly economic services. By capitalizing on these competitive rate of interest prices, credit scores union members can make the many of their financial sources and accomplish their cost savings and borrowing goals much more successfully.

Reduced Costs and charges

One significant attribute of lending institution is their commitment to minimizing fees and costs for their participants. Unlike traditional banks that usually prioritize optimizing earnings, lending institution operate this post as not-for-profit companies, permitting them to supply more favorable terms to their members. This distinction in structure translates to lower fees and lowered prices across various solutions, benefiting the participants directly.

Lending institution generally charge reduced account maintenance costs, overdraft account charges, and ATM costs compared to commercial financial institutions. Furthermore, they commonly use higher rates of interest on interest-bearing accounts and reduced rate of interest on fundings, leading to overall expense financial savings for their members. By maintaining charges and costs at a minimum, cooperative credit union aim to give economic solutions that are affordable and accessible, promoting a more comprehensive financial atmosphere for individuals and areas.

In essence, picking a credit rating union over a typical bank can bring about considerable price savings with time, making it a compelling choice for those seeking a more cost-effective approach to banking services.

Community Participation

With a strong focus on fostering close-knit connections and supporting neighborhood initiatives, credit score unions proactively take part in neighborhood involvement initiatives to empower and boost the locations they offer. Neighborhood participation is a keystone of cooperative credit union' worths, mirroring their dedication to offering back and making a favorable impact. Credit history unions typically join different community activities such as offering, sponsoring local occasions, and providing financial education programs.

By proactively taking part in neighborhood events and efforts, credit score unions show their commitment to the health and success of the communities they offer. This participation exceeds simply economic transactions; it showcases a real rate of interest in building strong, lasting communities. Via partnerships with local organizations and charities, cooperative credit union add to improving the top quality of life for locals and cultivating a sense of unity and assistance.

In addition, these neighborhood participation efforts aid to create a positive image for debt unions, showcasing them as relied on and trusted companions purchased the success of their members and the neighborhood at big. In general, area involvement is an essential aspect of credit unions' operations, strengthening their dedication to social responsibility and community advancement.

Verdict

Finally, credit scores unions offer various benefits such as autonomous control, far better rates of interest, lower funding rates, and minimized costs contrasted to for-profit financial institutions. With customized customer support, affordable view rates of interest, lower fees, and a commitment to area participation, cooperative credit union supply an one-of-a-kind worth proposition for their members. Highlighting monetary empowerment and community development, lending institution stick out as a desirable choice to typical for-profit financial institutions.

Report this page